tax attorney vs cpa salary

The national average salary for an attorney is 96043 per year. A CPA only offers attorney-client privilege if acting at the direction of a lawyer to give the client information relevant to the case.

Cpa Vs Tax Attorney What S The Difference

You should most likely hire a CPA if you need help with the business and.

. The benefits of having two different experts are difficult to overestimate. Published by the American Academy of Attorney-CPAs Whether you are seeking a professional to assist with tax issues on personal or business-related concerns it can be difficult to determine exactly which expert best fits your needs. One of the biggest advantages of hiring a tax lawyer over a CPA is the protection of your business through attorney-client privilege.

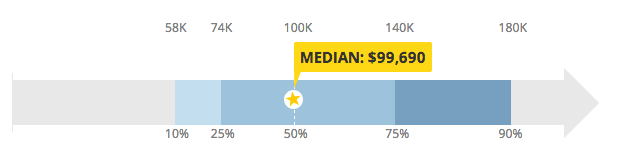

What salary does a Tax Attorney earn in your area. Salaries in the law field range from 58220 to 208000. Both are experts when it comes to tax matters but in different ways.

Includes base and annual incentives. Although employment and educational experience affect earnings the national average salary for a CPA is 80442 per year. These charts show the average base salary core compensation as well as the average total cash compensation for the job of Tax Attorney I in Los Angeles CA.

With two to four years of experience the tax attorney salary ranges from 107996 to 146664 with an. CPA Firm salary trends based on salaries posted anonymously by CPA Firm employees. Whether you need to hire a CPA or a tax attorney depends upon your tax needs.

A CPAs role focuses on maintaining your small businesss financial records preparing financial statements and preparing tax returns. Whether you need to hire a CPA or a tax attorney depends upon your tax needs. A Tax Attorney the strengths and weaknesses of each and when to reach out for tax and financial help.

You should most likely hire a CPA if you need help with the business and accounting side of taxes such as. Meanwhile CPA is typically used regularly to support your bank records and prepare your taxes. A Tax Attorney has a median salary of about 102K per year.

Filing taxes Finding all the tax deductions and credits you qualify for Bookkeeping or preparing financial documents Managing payroll. Some attorneys will charge a flat rate but this can be steep as well. The average annual salary for a tax preparer in the United States is 37017 per year.

The size of the organization you work for the number of hours you work each week and the cost of living in your area may also affect your salary. If you become a CPA you have the ability to make quite a bit more than a tax attorney. For the most up-to-date salary information from Indeed click on the salary link A CPA working for a large corporation may make significantly more annually.

EAs have passed a three-part comprehensive IRS exam covering individual and business returns. The range for a CPA will go from about 70K to 461K. CPAs are an ideal business partner to have for day-to-day accounting and tax issues.

The base salary for Tax Attorney I ranges from 92851 to 125995 with the average base salary. According to PayScale a tax attorneys salary starts around 80000 per year. Salary for the 25th percentile is 83500 dollars annually 6958 dollars monthly pay 1605 dollars weekly salary and the hourly wage is 40 dollars.

Read this blog to learn the difference between a CPA vs. If youre on a budget and just need help doing your taxes consider working with an Enrolled Agent or EA. Average salaries for CPA Firm Tax Attorney.

If youre just looking to minimize your tax liability and get the maximum benefit a CPA can be a much more cost-effective option. Tax Attorney Salary Entry-level tax attorney job salary ranges from 77735 to 105498. Your businesss CPA can also offer tax planning advice throughout the year to help minimize your tax liability.

As a tax preparer your salary may vary based on your educational background work experience and skill set. The average salary of a tax attorney is 120910 per year according to the BLS. Choosing who to hire.

Tax lawyers are almost always more expensive than CPAs although its possible to find attorneys with competitive rates. A tax attorney will charge an average of 200 to 400 per hour depending on their experience in the field and your reasons for inquiring. The median salary is about 265K.

Several factors may impact earning potential including a candidates work experience degree location and certification. The advantages of a dual-certified expert A tax attorney is often used for more specialized and sophisticated tax concerns. The average tax attorney CPA salary is 159500 dollars annually 13291 dollars monthly income weekly pay is 3067 dollars and the hourly wage is 77 dollars.

1 Tax Attorney Salaries provided anonymously by Cpa employees. There are so many financial advising specializations with innumerable designations that it eventually seems to become a confusing. While your CPA is an expert at preparing and submitting your taxes correctly youll need a tax attorney in the event that Internal Revenue Services IRS notices inconsistencies in your tax submissions or if youre the subject of an audit.

Tax attorney vs. If you do end up in court this legal protection of communications between you and your lawyer means you can seek help without the risk what you share privately coming out publicly in a trial.

Tax Attorney Vs Cpa What S The Difference

How To Become A Tax Attorney Jobhero

Tax Attorney Salary In United States All States 2022 Careerexplorer

Tax Law Salary Northeastern University Online

Cpa Vs Tax Attorney Top 10 Differences With Infographics

The Happiest Lawyers Are Tax Lawyers Going Concern

Average Accountant Salary How Much Do Accountants Make Accounting Salary Http Gazettereview Com 201 Accounting Companies In Dubai Accounting And Finance

Why Tax Lawyers Are The Richest Lawyers

Lawyer Salary Top 10 Law Careers Crush The Lsat 2022

What S The Difference Between A Cpa And A Tax Attorney Quora

Cpa Vs Tax Attorney Top 10 Differences With Infographics

![]()

Lawyer Salary Top 10 Law Careers Crush The Lsat 2022

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

What Is A Payroll Tax Payroll Taxes Payroll Tax Attorney

What Can You Do With An Accounting Degree Accounting Degree Accounting Jobs Accounting

Tax Attorney Salary In United States All States 2022 Careerexplorer